Plettenberg bay annual property sales figures 2024

Friday, February 21, 2025

The recently released property sales figures for Plettenberg Bay and surrounds reflect the turbulence of the past year, says Helen Ward, principal of Helen Melon Properties. The National Deeds Office sales figures for the year are down 4.84% from 2023, with 551 sales compared to 579. These numbers showcase twelve months marked by national elections, loadshedding and economic uncertainty.

This trend is apparent in the fourth quarter sales figures, as below, where sales for 2023 outstripped sales in 2024.

2023 sales – 130. 2024 sales – 127.

Diving deeper into these figures, the trends for best performing suburbs and price brackets highlight several interesting factors in the residential property market.

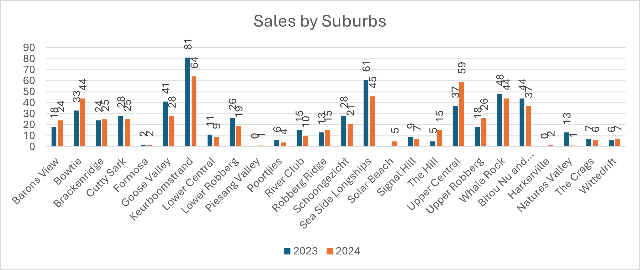

A CLOSER LOOK AT SALES BY SUBURB:

The figures for Upper Central still reflects the anomaly created by the release of The Plett Quarter residential apartments – showing a year on year increase of 59.46% - and keeping the suburb in the top performers.

Despite the impressive increase in Upper Central, the top performing suburb is Keurboomstrand. With the sale of 64 properties in 2024, this is still a decrease of 20.99% from 2023, where 81 properties sold.

Seaside Longships has the largest drop with only 45 sales in 2024 compared to 61 in 2023, reflecting a whopping 26.23% decrease.

Bowtie and Whale Rock both reflect sales of 44 properties each in 2024. Bowtie showing an increase of 33.33% from 2023 and Whale Rock showing a decrease of 8.33% year on year.

Helen Ward comments that the lack lustre performance of the property market in 2024 could be attributed to the impact of the national elections and the slow reversal of the Western Cape semigration trends that outstripped the modest interest rate cuts and improvements in certain key areas such as electricity supply.

SALES BY PRICE BRACKET:

The year-on-year sales by price bracket may reveal something that many Plett residents are already aware of, that Plett is establishing itself as a very high-end market for properties and the coastal lifestyle.

There was a marginal increase of 1.56% in sales of 0 - 1 million which is mainly vacant stands, and a decrease of 18.58% in the R1 – R5 million brackets. This may be due to the realisation for many that replacing a property within these brackets, especially in the freehold market, is not a forgone conclusion in Plett, where high end properties are the mainstay of the market. The lack of stock in houses that are priced below 5 million may also play a part in these figures.

There is marked increase in sales in the R5 – R7 million bracket with sales of 50 in 2023 shooting up to 80 in 2024. Another large jump in figures is to be found in the R7 – R10 million bracket, where sales reflect a 78.57% increase from 28 to 50 year on year.

These brackets and their upward trend could indicate that Plett is finding itself in the high-end property niche along the Garden Route. Already well known as the jewel of the Garden Route, it could be that property purchasers are discovering that purchasing a property in Plett comes with a price tag. Adding to this argument, says Helen Ward, is the differential between average asking and selling prices which is currently around 39% in Plettenberg Bay.

The drop in sales figures in the R10 million and above bracket may be reflecting that the very wealthy remain concerned about South Africa as an investment risk, with many preferring to invest less in the country and to keep most of their assets or cash offshore for security. (Information referenced from BusinessTech article by Malcolm Libera, 22 jan 2025: Dawie Roodt’s advice for people staying in South Africa – BusinessTech)

Nationally property sales figures for 2024 indicate the possibility of mild to moderate property sales in 2025. The interest cuts seen so far have remained moderate and have tempered the potential growth stimulating effects. Great strides have been made in areas such as the electricity supply, but other areas remain sadly lacking, creating a dampening effect on the otherwise positive movement in the country. With other key factors to monitor, such as the Trump presidency and the South African government’s ability to build investor confidence and address economic challenges, it will be interesting to see whether the promised interest rate cuts and cautious positivity in the country will boost the property market.